Loanable Funds

Essential Question: What factor has the biggest impact on the money supply, lending and investment?

- Interest Rates (the price of borrowing & using money)

Nominal v. Real Interest Rates

Nominal:

- Real interest rates + expected inflation

- % increase in money that the borrower pays including inflation

Real:

- Nominal interest rate - expected inflation

- % increase in purchasing power that the barrow pays (adjusted)

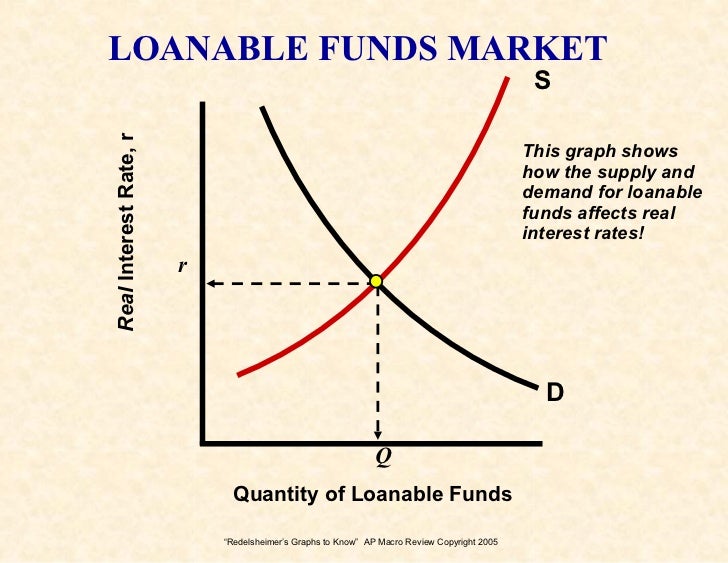

What are loanable funds?

-funds available for borrowing or lending

Demand for Loanable Funds

- the quantity of credit wanted and needed at every real interest rate by borrows in an economy

- Loanable Funds demand consists of any and all activities of borrowers who were credit, including: loan application and financial asses sales.

Demand for loanable funds?

- the quantity of credit wanted and needed at every real interest rate by borrowers in an economy

- Loanable funds demand - consists of any and all activities of borrowers who desire credit, including: loan application and financial asset sales.

Time Value of Money

Is a dollar today worth more than a dollar tomorrow? YES

Why?

- inflation and opportunity cost

- this is the reason for charging and paying interest

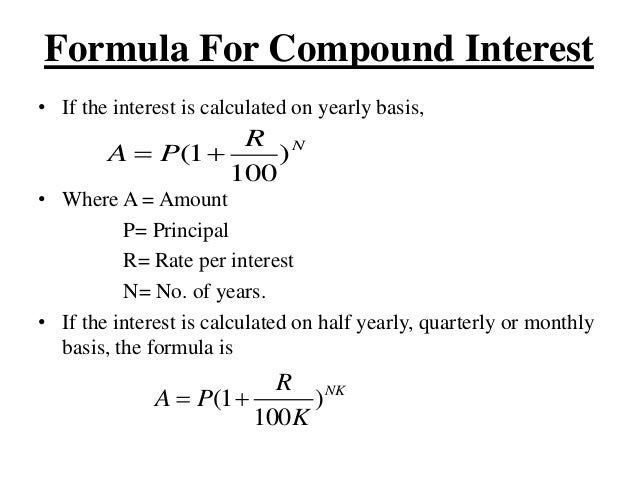

Let V = future value of $.

P = present value of $.

r = real interest rate ( nominal rate - inflation expressed as a decimal)

n = years

k = # of times interest is credited per year

Demand Money

- has an inverse relationship between nominal interest rates and the quantity of money demanded

- quantity demanded falls because individuals would prefer to have interest earning assets instead of borrowed liabilities

What happens to quantity demand when interest rate decreases?

- quantity demanded increases.

- There is no incentive to convert cash into interest earning asset.

What happens if price level increase?

- then money demand shift to the right

3 Causes:

- change in price level

- change in income

- changes in taxation that affects investment

Increasing Money Supply

If the FED increases the money supply, a temporary surplus of money will occur at 5% interest.

- the surplus will cause interest rate to fall 2%

How does this affect AD?

Increase MS > Decrease interest rate > increase investment > Increase in AD

How do we decrease Money supply?

Decrease MS > Increase interest rate > decrease investment > decrease AD

Fiscal Sector

- Financial assets vs. Financial liability

- Assets: stocks or bonds that provide expected future benefit.

: benefits the owner only if the ensure of the asset need certain obligation

- Liability: it is incurred by the ensure of a financial asset to stand by the issue asset

: what you owe - Interest Rates: it is the price paid used for financial assets

- stock v. bonds

- stocks: financial asset that convey ownership in cooperation- bonds: promise to pay a certain amount of money

and interest in the future

What do Banks do?

A bank is financial intermediary

- uses liquid assets (i.e bond deposits) to finance the investment of borrowers

- Process is known as fractional reserve banking

- system in which depository institution liquid assets less than the amount of deposit

- can take the form of:

1. currency in bank vaults

2. bank reserves - deposits held at the Federal Reserve

Basic Accounting Review

- T-account (balance sheet)

- statements of assets and liabilities - Assets (amount owned)

- items to legal to which a bank holds legal claim

- the uses of funds by financial intermediates - Liabilities (amount owned )

- legal claim against a bank

Federal Reserve Bank

Function of FED:

- it issues paper money

it sets reserve requirement and it hold reserve of the bank

- lend money to bank and change their interest

-check clearing service for bank

-acts as a personal bank for government

- supervises member banks

- control money supply

No comments:

Post a Comment