3 Tools of Monetary Policy

1) Reserve Requirements:

- Only a small percent of you bank deposit is in the safe. The rest of your money has been loaned out. This is called Fractional Reserve Banking

- FED sets the amount that bank must hold

- RR is % of deposits that banks must hold in reserve and NOT loan out.

- When FED increase the MS it increases the amount of money held in bank deposit.

a) if there's a recession, what should the FED do to the RR?

1) Bank hold less money and have more ER

2) Banks create more $ by loaning out express

3) MS supply increases, interest rates fall, AD goes up

b) if there inflation, what should to FED do to the reserve requirements?

1) Banks hold more money have less ER

2) Banks create less $

3) MS decreases, interest rates up, AD down

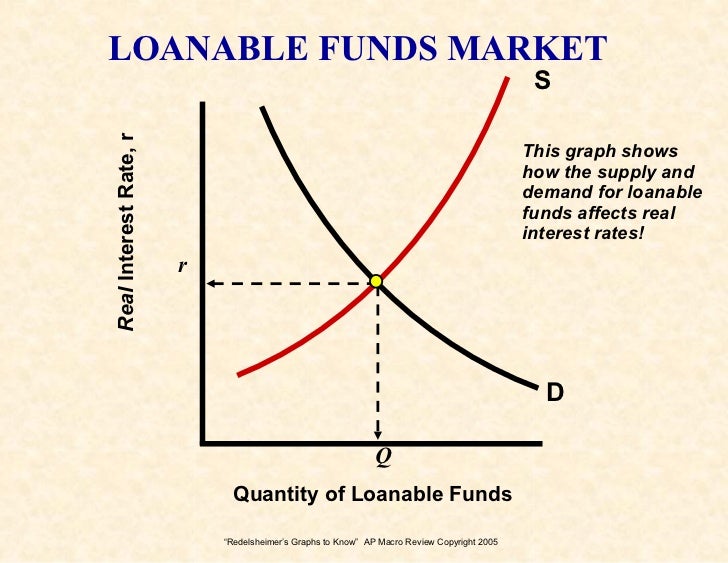

2) The Discount Rate

the interest rate that the FED charges commercial bank

- To increase the MS, the FED should decrease the discount rate ( easy money policy)

- To decrease the MS, FED should increase the discount rate ( tight money policy )

3) Open Market Policy

- FED buy/sell government (securities)

- This is the most important and widely used monetary policy

- to increase MS, FED should buy government securities

- to decrease MS, FED should sell government securities

When a customer deposits cash or withdraws cash from their demand deposit account, it has no effect on money supply. It only changes:

- The composition of the money

- Excess Reserves

- Required Reserves

How does it effect the three:

Effect ER & RR because the

Single bank: loan money from ER

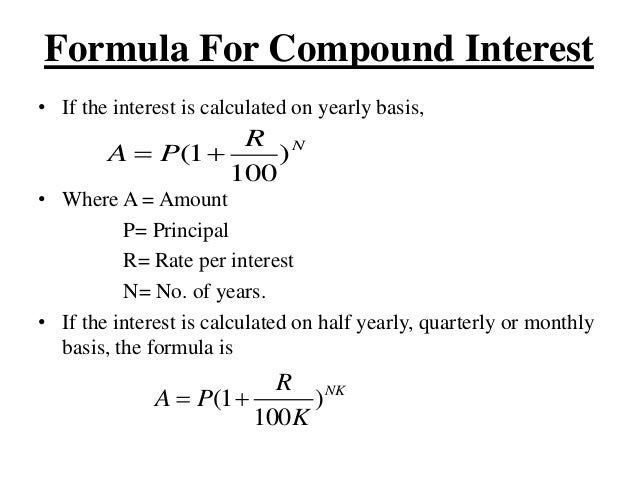

Banking System : ER x Multiplier (1/rr)

*total money supply*