Aggregate Demand Curve:

AD = Consumption Expenditures + Gross Private Domestic Investment + Government spending + Net Export

= (C+Ig+G+Xn)

Aggregate Demand is the demand by consumers, business, government & foreign.

What definitely doesn't shift the curve?

changes in price level cause a move along the curve.

Why is AD downward sloping?

1. Real-Balance Effect

- higher price levels reduce the purchasing power of money, which decreases the quantity of expenditures

- lower price levels increase purchasing purchasing power and increases expenditures.

ex: If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will likely reduce your spending.

2. Interest-Rate Effect

- when the price level increases, leaders need to change higher interest rates to get a REAL return to their loans.

- Higher interest rates discourage consumer spending and the business investment.

3. Foreign Trade Effect

- When U.S. price level rises, foreign buyers purchase fewer U.S. goods and Americans buy more foreign goods.

- Exports fall and imports rises causing real GDP demand to fall (Xn decreases )

ex: If the price triple in the U.S., Canada will no longer buy U.S. goods causing quantity demanded of U.S. products to fall.

What are the shifters of aggregate demand?

1) A change in C, Ig, G, Xn

2) a multiple effect that produces a greater change than the original change in the four components

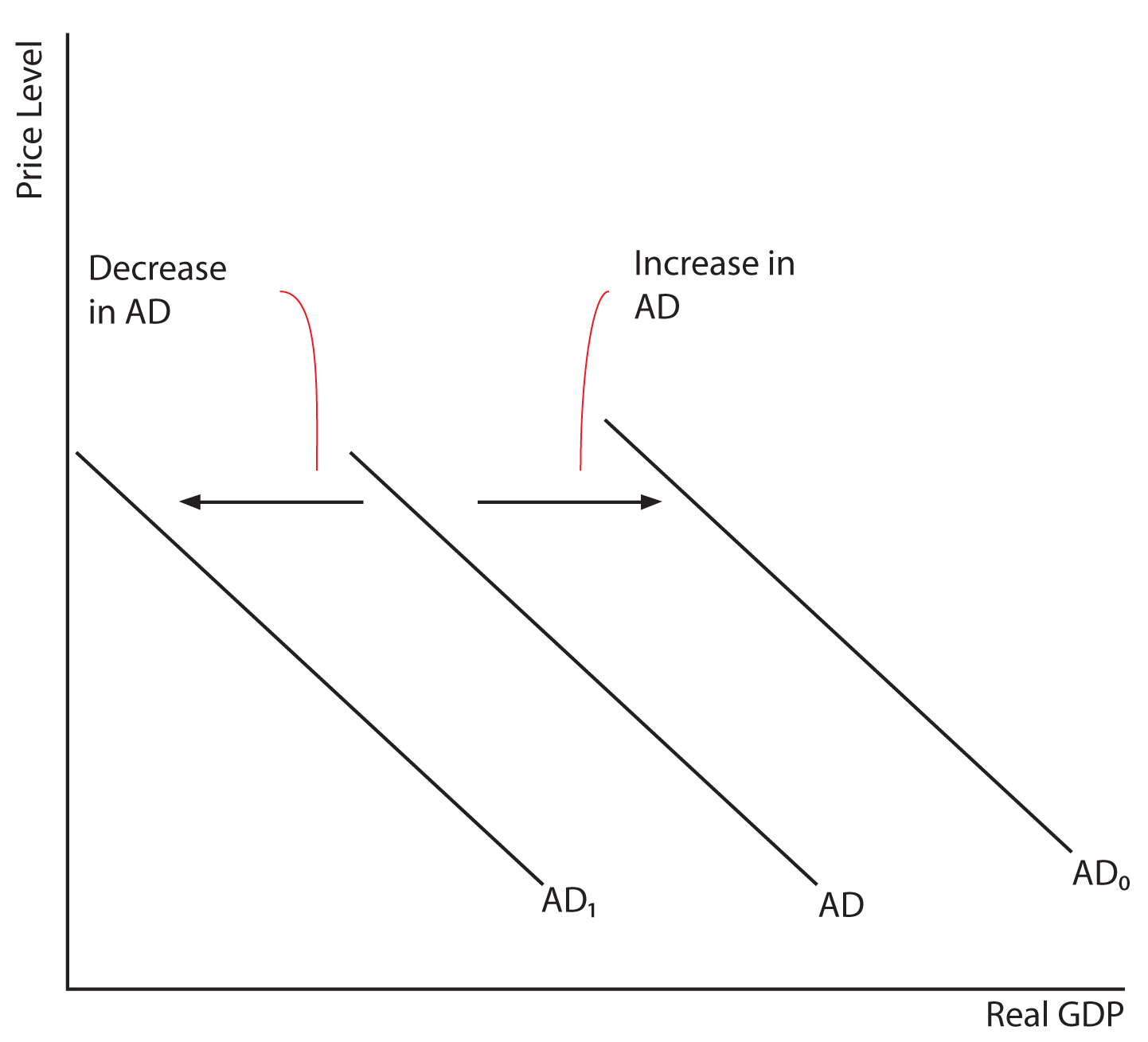

Increase in AD = AD -->

Decrease in AD = AD <--

Determinants of Aggregate Demand:

1) Consumption

Household spending is affected by :

• Consumer wealth

- More wealth = more spending (AD shift --> )

- Less wealth = less spending (AD shift <-- )

• Consumer expectation

- positive expectations = more spending (AD shift --> )

- negative expectations = less spending (AD shift <-- )

• Household indebtedness

- less debt = more spending (AD shift -->)

- more debt = less spending (AD shift <--)

2) Gross Private Investment

Investment spending is sensitive to :

• Real Interest Rate

- lower real interest rate = more investment (AD shift -->)

- higher real interest rate = less investment (AD shift <--)

• Expected Returns

- higher expected returns = more investment

- lower expected returns = less investment (AD shift <--)

- expected returns is influenced by :

○ expectations in the future profitability

○ technology○ degree of excess capacity ( existing stocks of capital )

○ business

3) Gov. spending

• more gov. spending (AD shift -->)

•less gov. spending (AD shift <--)

4) Net Exports

sensitive to:

• Exchange rates (international value of $)

- strong $ = more imports & fewer exports (AD shift -->)

- weak $ = fewer imports & more exports (AD shift <--)

• Relative income

- strong foreign economies = more export (AD shift -->)

- weak foreign economies = less export (AD shift <--)

Aggregate Supply:

What are the difference between Long Run and Short Run?

Long Run:

• period of time where input prices are completely flexible and adjust to changes in the price level

• level of Real GDP supplied is independent of the price level

Short Run:

• period of time where input prices are sticky and do no adjust to change in the price level

• the level of Real GDP supplied directly related to the price level

Long-Run Aggregate Supply (LRAS)

- marks the level of full employment in the economy (analogous to PPC)

- because input prices are completely flexible in long run, change in price level do not change firms real profits and therefore do not change firms level of output. (This means LRAS is vertical at the economy's level of full employment)

Change in SRAS

- An increase in the SRAS is seen as a shift to the right (SRAS -->)

- A decrease is seen as shift to the left (SRAS <--)

Total Input Cost

___________________

Total Output

Determinant of SRAS (all affect unit production cost)

1) Input Prices

• Domestic Resource Prices:

- Wage (75% of all business cost)

- Cost of capital

- Raw material (commodity prices)

• Foreign Resource Prices

- strong $ = lower foreign resource

- weak $ = higher foreign resource

• Market Power

Increase in Resource Prices = SRAS <--

Decrease in Resource Prices = SRAS -->

2) Productivity

• Productivity = Total Output / Total Input

More productivity = lower unit production cost = SRAS -->

Lower Productivity = higher unit production cost = SRAS <--

3) Legal-Institution Environment

• Taxes & Subsides:

- Taxes ($ to government) on business increase per unit production cost = SRAS <--

- Subsides ($ from government) to business reduce per unit production cost = SRAS -->

Full employment, Recessionary Gap, Inflationary Gap

Full Employment :

Recessionary Gap:

- exists when equilibrium occurs bellow full employment output

Inflationary Gap:

- exists when equilibrium occurs beyond full employment output

SRAS (Short Run Aggregate Supply)

Nominal wages - the amount of money receive by worker per unit of time

Real Wages - The amount of goods and services a worker can purchase with their nominal wages.

Sticky wages - Where nominal wage level is set according to an initial price level and it does not vary due to labor contracts or other restriction