Unit 7

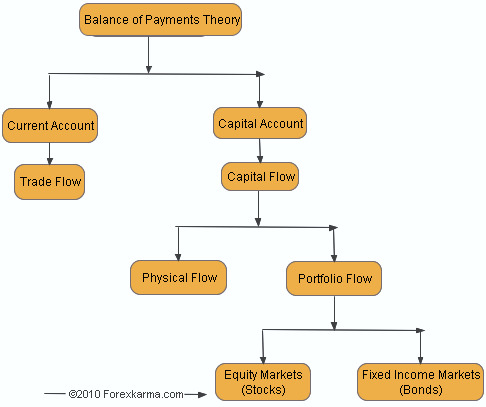

Balance of payments

- Measure of $ inflows and outflows between the US and the rest of the world (Row)

*outflows are referred to as DEBITS

- The balance of payments is % into 3 accounts

*capital/financial account

*official reserves account

Current Account

- Balance of trade and net exports

*exports create a credit to balance of payments

*imports create a debit to the balance of payments

- Net foreign income

Ex. interest payments on US owned Brazilian bonds. Interest payments on German owned US treasury bonds.

- Net transfers (tend to be unilateral)

Capital/Financial Account

- The balance of capital ownership

- Includes the purchase of both real and financial assets

- Direct investment in the US is a credit to the capital account

- Direct investment by US firms/individuals in a foreign country are debits to the capital accounts

- Purchase of foreign financial assets represents a debit to the capital account

- Purchase of domestic financial assets by foreigners represents a credit to the capital account

Official Reserves

- The foreign currency holdings of the US federal reserve system.

- When there is a balance of payments surplus the FED accumulates foreign currency and debits the balance of payments.

- When there is a balance of payments deficit the FED depletes its reserves of foreign currency and credits the balance of payments

- The official reserves 0 out the balance of payments

The United States is passive in its use of official reserves. It does not seek to manipulate the dollar exchange rate

Formula!!

Balance of trade:

Goods exports + Good imports

Balance on goods and services:

Goods exports + service exports + goods imports + service imports

Current Account:

Balance on goods and services + net investment + net transfers

Capital Account:

foreign purchases + domestic purchases

Foreign exchange (FOREX)

- The buying and selling of currency

- Any transaction that occurs in the balance of payments necessitates foreign exchange

Changes in exchange rates

- Exchange rates (e) are a function of the supply and demand for currency.

- An increase in the S of a currency will decrease the exchange rate of a currency

- A decrease in S of a currency will increase the exchange rate of a currency

- An increase in D for a currency will increase the exchange rate of a currency

- A decrease in D for a currency will decrease the exchange rate of a currency

Appreciation and depreciation

- Appreciation of a currency occurs when the exchange rate of that currency increases

- Depreciation of a currency occurs when the exchange rate of that currency decreases

Exchange rate determinants

1. Consumer's taste

2. Relative income

3. Relative price level

4. Speculation

Exports and imports

- The exchange rate is a determinant of both exports and imports

- Appreciation of the $ causes American goods to be relatively more expensive and foreign goods to be relatively cheaper thus reducing exports and increasing imports

Fixed rates

- Based on a country's willingness to distribute currency and to control the amounts

- The US uses a fixed rate the $1 stays $1

Absolute advantage

- Individual- exists when a person can produce more of a certain good/service than someone else in the same amount of time (or can produce a good using the least amount of resources)

- National- exists when a country can produce more of a good/service than another country can in the same time period

Comparative advantage

- A person or a nation has a comparative advantage in the production of a product when it can produce the product at a lower domestic opportunity cost than can a trading partner

Specialization and trade

- Gains from trade are based on comparative advantage, not absolute advantage-Examples output:

- tons per acre

- miles per gallon

- words per minute

- apples per tree

- television produced per hour

Examples input:

-# of hours to do a job

-# of acres to feed a horse

-# of gallons of paint to paint a house